SERVING THE WORLD’S PREMIER FILM DESTINATION

Orlando Film Commission

Scroll to see more about Orlando

One-Stop Shop for Production Needs

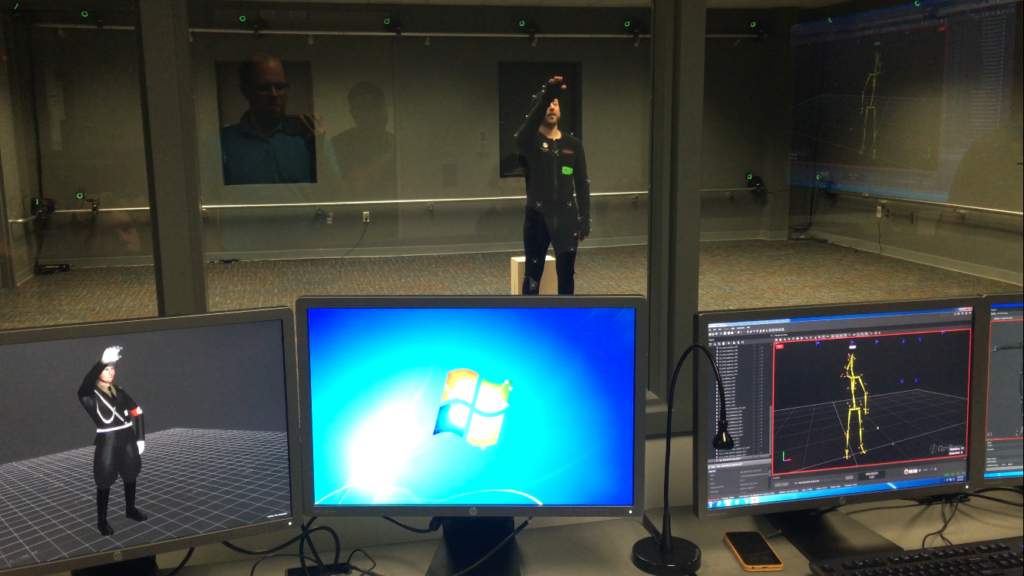

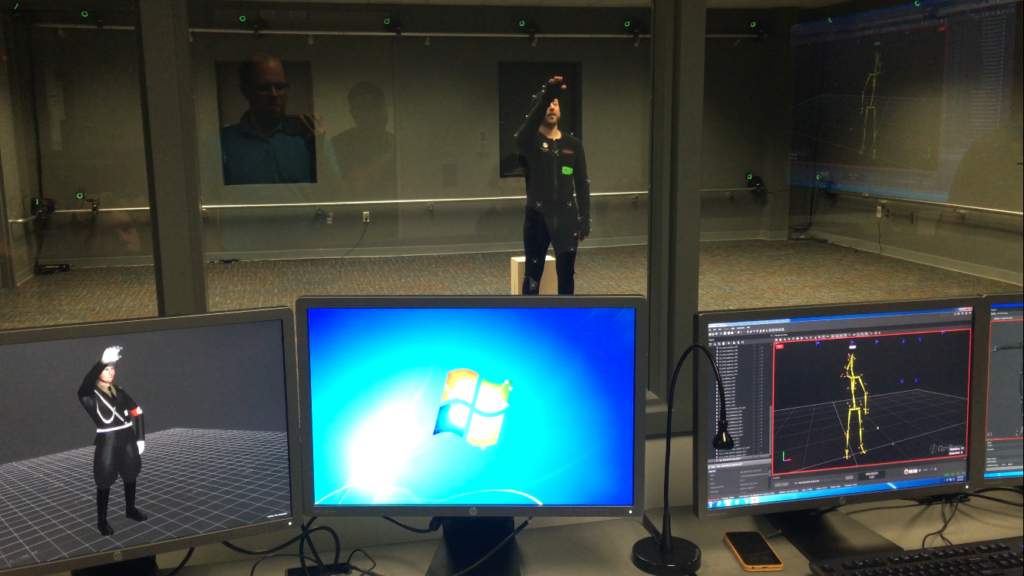

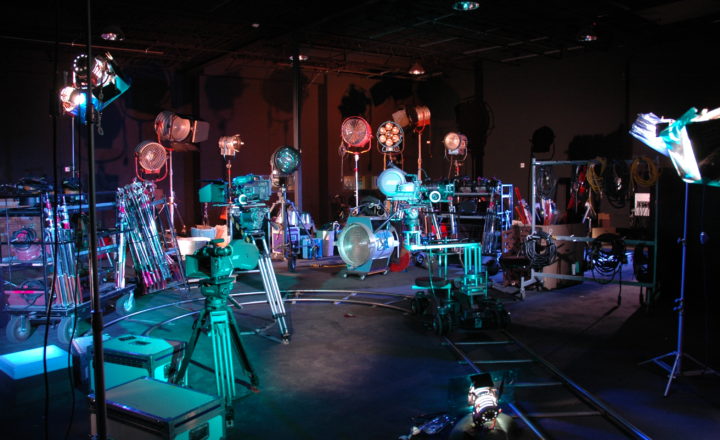

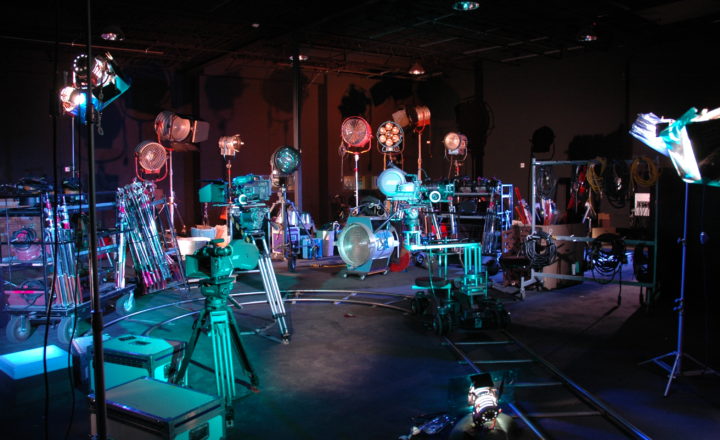

Well-known as the world’s premier tourist destination, the Orlando region is also a leading destination for film, television, commercial and web production. State-of-the-art soundstages and unique locations have made the region one of the busiest production centers in the United States.

-

Rolling Hills, Wild Swamps, Lush Jungles, Unspoiled Pastures, Lakes, Springs and Cities

-

An Average Temperature of 83 Degrees Fahrenheit

-

Over 4,000 Miles of Diverse Locations

Production Directory

Locate skilled crew and qualified companies to support any production from inception to completion.

Locations

In addition to permitting services, the Orlando Film Commission also assists with location needs.

Permitting

The Orlando Film Commission serves as the liaison between productions and local jurisdictions.

Resources

InCentives

Florida Entertainment Sales Tax Exemption

Any qualified production company producing motion pictures, made for television motion pictures, television series, commercial advertising, music videos or sound recordings in Florida, may be eligible for a sales and use tax exemption on certain production-related purchases in Florida. To be exempt from Florida’s sales tax at the point of sale, the production company must apply for a certificate of exemption.

If you are unable to apply online, or are having trouble with the links above, please contact Helena.Sadvary@commerce.fl.gov or call 850.717.8990.

Florida Film Incentive Program Advocacy

Film Florida is a not-for-profit association that provides a leadership role in Florida’s film and entertainment industries. The Orlando Film Commission is a proud supporter of and an active member in this group.

Film Florida encourages its members and industry stakeholders/partners to actively participate in the legislative process. They have put together an Advocacy Toolkit for your convenience, designed to help you understand the political framework and provide the resources necessary to get involved in the legislative process. By becoming an active participant with Film Florida, you can help strengthen the influence the film and entertainment industries have with our elected officials in the state of Florida.

Labor Laws

Crew

As a right-to-work state, Florida provides employers and employees with a substantial degree of flexibility. While Florida should not be considered a non-union state, employers, by state law, have the right to hire anyone they choose, whether that person belongs to a union or not. At the same time, membership in a union cannot be a requirement for employment. The decision whether to join a union in Florida is up to individual employees. Union leaders eagerly support production and are known to be very flexible with visiting production companies. Production companies may hire, at their discretion, both union and non-union employees for the same production. Union members have the right-to-work as non-union employees, and many times will do so, but employers may still be asked to negotiate a contract with the union.

Minors/Child Labor

In order to hire minors (under age 18), an employer must obtain an Entertainment Industry Permit to Hire from the Florida Department of Employment Security, Division of Child Labor. Any minor to be hired must have this permit before hiring is official and the work begins. The department will assist the employer through this process once initial contact is made

The Florida Child Labor Law and the Federal Fair Labor Standards Act provide the rules and regulations that govern the employment of minors in Florida. They also govern the working relationship between minors and their employers. The Child Labor Law is administered and enforced by the Department of Business and Professional Regulation in cooperation with law enforcement officers, public school officials, and other agencies that may assist the division through intergovernmental agreements.

The Child Labor Compliance Section’s primary goals are:

- To protect the health and education of working youth of the state by ensuring enforcement of restrictions established to protect them from harmful work situations; and,

- To educate employers, public school employees, the general public, and working youth about the Child Labor Law.

For more information, call Florida’s Division of Professions/Child Labor Program at 800.226.2536.

Talent

Orlando is unique in that many producers feel the region has more “Working actors” (per capita) than any other region in the U.S. Talent make their living doing commercials, industrials videos, feature films, and TV projects at many of the local studios. Moreover, since the region is the number one tourist destination in the world, these talented actors also find themselves on stage year-round performing for live conventions, dinner theaters, and the dozens of live shows at the many theme parks and attractions that only Metro Orlando offers. Here are some hard facts:

- an estimated 1,500 SAF and AFTRA members

- over 10,000 trained SAG eligible and non-union talent

- over 15,000 extra performers

- close to 40 acting schools

- dozens of talent agents and award-winning casting directors

- over a dozen state-of-the-art casting facilities

- eight full-time film schools

- number one choice for below- and above-the-line talent for many directors!

Talent/Modeling Agencies

Regulations affect all talent and modeling agencies operating within Florida. They must be licensed through the Department of Business and Professional Regulation, 850.487.1395.

To be considered a “talent agent” according to the Florida Department of Business & Professional Regulation’s definition, you must, for compensation, engage in the occupation of procuring or attempting to procure engagements for an artist. This means you must have a talent agency business license to operate. By law, this definition applies regardless of your title (manager, casting director, casting agent, promoter, etc.). If you think you may need a license, visit DBPR Talent Agencies.

Hiring a “talent agency” without a license is also against the law and serves as grounds for the DBPR to take action against you. Violation of the law will be punished by either, denying an application for licensure as a talent agency, permanently revoking or suspending a license, imposing an administrative fine of up to $5,000 or requiring restitution. To check on the license status of a talent agency, visit DBPR Online Services.

The Orlando Film Commission constantly receives inquiries concerning the legitimacy of casting calls . While many films use newspapers to advertise an open casting call, legitimate films or projects always provide a specific film or project name and some of the principal people involved in it.

Please note that legitimate agencies or casting directors DO NOT REQUIRE A PAYMENT UPFRONT to register or include you on their roster. They may ask for a nominal fee ($2) to take a single reference picture if you can’t provide one yourself, but under no circumstance should you pay them for an “application” or “registration” fee for any future films or projects down the road. Open casting calls are timed to coincide with a LOCAL film currently in pre-production or production.

Also, if they aren’t willing provide you with written documentation as to which particular film or print ad they are working with, consider this a serious red flag.

Fees are charged once, and, only if, the agency has obtained an acting position for you.

If you are aware of any wrongdoing as described above, contact your local DBPR Bureau of Investigation. You will be granted anonymity on request. You may also file a complaint online. Visit www.myflorida.com/dbpr under “DBPR Features” click on “File an unlicensed activity complaint”.

For more information about the regulation of Talent & Modeling Agencies, contact:

Division of Professions

Talent Agencies

1940 North Monroe Street

Tallahassee, FL 32399-07834

850.487.1395

Orlando Film Commission Staff

Connect With Us

For all production-related inquiries, contact Brooke Hill at the Orlando Film Commission.

Brooke Hill

Coordinator, Innovation & Technology | Orlando Film Commission

News about Filming in Orlando

14 Films at the 2019 Florida Film Festival with Orlando Connections

Orlando Wins Production of New Oprah Winfrey Network Series Press Release

13 Movies You Didn’t Know Were Filmed in Orlando